A rare blend of strategic rigor and human insight.

Our team is designed to support family complexity. With complementary strengths and aligned values, we bring a rare combination of strategic rigor and human understanding. Our diverse thinking and working styles allow us to see what others miss, respond to what’s emerging in the room, and deliver consistently high-quality outcomes for the families we serve.

Experience-Based Guidance

Gregory T. Rogers

Founder & Managing PartnerGreg founded RayLign in 2004 based on the integration of three key components of his life and career – families working together, aspirational strategy development and long lasting positive human relationships. As the company name suggests, the business focuses on the “align”ment of the many stakeholders participating together on the dynamic path toward sustaining well-being through the generations. He has built a team, services and network to be a “ray” of light for modeling highly collaborative, transparent and empathic interaction across the family system.

Read Greg’s full bio below

Barbara Mach-Oleksak

PartnerBarbara Mach-Oleksak is passionate about helping families build strong dynamics and move through complexity with care. She brings years of experience in Family Office leadership and process management, and has spent the past 10 years being closely mentored by Greg Rogers—deepening her commitment to thoughtful facilitation, collaboration, and exceptional consideration for all stakeholders.

With a background in social work and a love for connection, Barbara focuses on building trust and creating meaningful relationships with the families RayLign serves and the advisors and colleagues they partner with.

She earned her BA in Social Work from the University of Saint Joseph and her Master of Social Work from Fordham University. Outside of work, Barbara loves the outdoors and can often be found running, cycling, or hiking. Cooking, photography, videography, and gardening are favorite hobbies that bring creativity and balance to her days.

Molly Monahan-Grunner

Family Enterprise Relationship ManagerMolly Monahan Grunner runs our operation engines making sure they are running smoothly while also driving project management for our family clients.

As Estate Manager for a New York City family, she spent 16 years working with the principals on major projects from ground-up construction to philanthropic events, while also creating systems for household maintenance and inventory management, and supervising the household staff across multiple residences. Most recently, Molly served as Chief of Staff for a single-family office where she further developed and honed her larger management style, recruiting skills, and HR experience.

She earned her BA from Fordham University, majoring in English and minoring in Irish Studies. In her free time, she produces the radio show, Ceol na nGael, on WFUV and volunteers with The Players Foundation for Theatre Education. Molly lives in Manhattan with her husband, David, and their dog, Bowie.

Meet Greg

I founded RayLign in 2004 as an administrative family office and family enterprise consultancy based on the integration of three key components of my life and career – families processing decisions together, aspirational strategy development and long lasting positive human relationships.

My practical and very personal family enterprise experience is based on a series of career roles: John A. Levin & Co Vice President & Chief Operating Officer as an organizational leader of a publicly-listed, family-led asset management company that grew to over $13 billion in assets under management with an array of long only and hedge fund products during early formation of the wirehouse and RIA client channels; BARRA Strategic Consulting Group Managing Director as builder of a strategic consulting practice for global asset management companies using leading edge quantitative analysis that included Angelo Gordon, Barclays, Bridgewater, Goldman Sachs and Fidelity; Rogers Casey Managing Director at his family business engaging in asset manager due diligence and investment program design on behalf of large institutional investors such as the Dupont Pension, Kodak Pension, New York City Retirement System, and the Virginia Retirement System (and included participation in the sale of the business to BARRA in 1996); IBM during their initial recognition of the need to evolve from product to consulting; and Sanford C. Bernstein & Co. during the early stages of Lew Sanders investment process leadership and early adoption of separate accounts to support the budding private client segment.

In addition to building out an administrative family office platform for three primary families and leading strategic enterprise-wide consulting engagements for dozens of enterprising families, I managed projects on behalf of clients to evaluate their complex set of service needs, get educated about the wealth management industry models as well as select, onboard and monitor relationships with leading multi-family offices that have included Ballentine Partners, BBR, Brown Advisory, Goldman Sachs, Glenmede Trust, Gresham Partners, Matter Family Office, Offit Capital, Pitcairn Family Office, SCS Capital, Tiedemann, Truist GenSpring, WE Family Offices and UBS.

I graduated from Brown University with majors in Economics and Organizational Behavior, and the NYU Stern School of Business with a Master of International Finance. Over the past two decades he has played a variety of leadership and membership roles building a vast network of relationships and experience-based perspective across the family enterprise ecosystem that includes Collaboration for Family Flourishing, Family Office Regional Group of Executives (FORGE), Fidelity Family Office Services, Greenwich Academy, Purposeful Planning Institute, TIGER21 and the Ultra High Net Worth Institute. In addition, I accessed extensive family systems therapy training and was a long-standing Board member (including Board Chair) at the Ackerman Institute for the Family.

I try to prioritize a life of mindful balance that prioritizes time with his wife and adult children (and dogs), fun with family and friends, daily acai bowls and fast walks, brain teaser puzzles, golf, lacrosse and as drummer in rock band hi-fidelity.

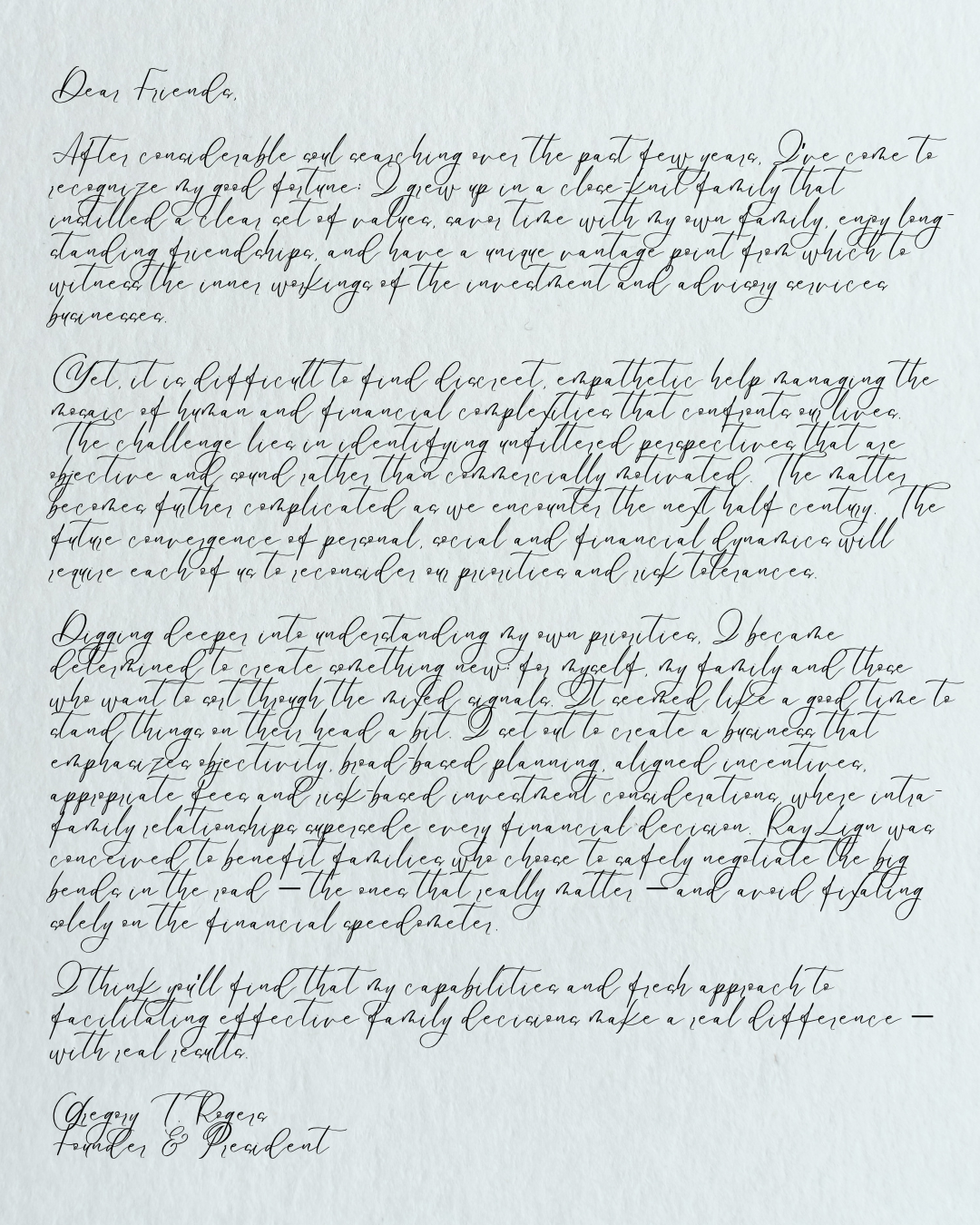

Founders Letter | 2005

March, 31st, 2005

Dear Friends,

After considerable soul searching over the past few years, I’ve come to recognize my good fortune; I grew up in a close-knit family that instilled a clear set of values, savor time with my own family, enjoy long-standing friendships, and have a unique vantage point from which to witness the inner workings of the investment and advisory services businesses.

Yet, it is difficult to find discreet, empathetic help managing the mosaic of human and financial complexities that confronts our lives. The challenge lies in identifying unfiltered perspectives that are objective and sound rather than commercially motivated. The matter becomes further complicated as we encounter the next half century. The future convergence of personal, social and financial dynamics will require each of us to reconsider our priorities and risk tolerances.

Digging deeper into understanding my own priorities, I became determined to create something new; for myself, my family and those who want to sort through the mixed signals. It seemed like a good time to stand things on their head a bit. I set out to create a business that emphasizes objectivity, broad-based planning, aligned incentives, appropriate fees and risk-based investment considerations, where intra-family relationships supersede every financial decision. RayLign was conceived to benefit families who choose to safely negotiate the big bends in the road — the ones that really matter — and avoid fixating solely on the financial speedometer.

I think you’ll find that my capabilities and fresh approach to facilitating effective family decisions make a real difference — with real results.

Gregory T. Rogers

Founder & President